Financial Accounting book download 👇

Some important questions for exam.

1. What do you mean by accounting. discuss its nature and significance.

2. What are accounting standards? What Procedure adopted for formulating accounting standards? Discuss its objectives.

3. Define accounting concepts and Principles.

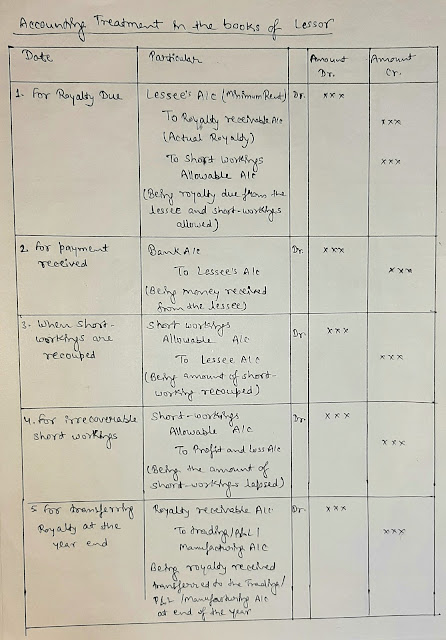

4. What do you mean by royalty account.

(Numericals on royalty ).

5. Define hire purchase system. What are its characteristics? Mention its advantages and disadvantages.

6. Define installment purchase system. What are its characteristics? Distinguish between the hire purchase and installment purchase system.

7. Define branch and branch accounting. Mention the objectives of branch accounting. Explain its need and importance.

7. What are various types of branch? Between dependent branch and independent branch.

8. Explain the concept of dissolution of partnership and dissolution of firm. Also distinguish between them.

9. How accounts are settled in case of dissolution of partnership firm?

10. What do you mean by Voyage Account. And it's Numericals.

11. What do you mean by insurance? discuss its characteristics & it's types.

12. What do you mean by Insurance claim ?

Accounting definition:-

."Accounting is the art of recording, classifying and summarizing in a significant manner, and in terms of money transaction and event which are, in part at least, of a financial character and interpreting the result thereof."

"Accounting is a process of identifying, measuring and communicating economic information to permit informed judgement and decision by users of information." - American Accounting Information

"Accounting is nothing but a means of communicating the results of business operations to varies parties, interested in or connected with the business, viz., the owner, creditors, investors, government, financial institutions and other agencies. Accounting is therefore, rightly called the language of business."

Financial Accounting:

The term ‘Accounting’

unless otherwise specifically stated always refers to ‘Financial

Accounting’. It is commonly carrying on in the general offices of a

business. It concerns with revenues, expenses, assets, and liabilities

of a business house. Also, they have the two-fold objective, viz,

- To ascertain the profitability of the business, and

- To know the financial position of the concern.

Nature and Scope of Financial Accounting:

Financial

accounting is a useful tool to manage and to external users such as

shareholders, potential owners, creditors, customers, employees, and

government. It provides information regarding the results of its

operations and the financial status of the business.

The following are the functional areas of financial accounting:-

1] Dealing with financial transactions: Accounting

as a process deals only with those transactions which are measurable in

terms of money. Anything which cannot be expressed in monetary terms

does not form part of financial accounting however significant it is.

2] Recording of information: Accounting

is the art of recording financial transactions of a business concern.

There is a limitation on human memory. It is not possible to remember

all transactions of the business. Therefore, the information is recorded

in a set of books called Journal and other subsidiary books and it is

useful for management in its decision-making process.

3] Classification of Data: The

recorded data arrange in a manner to group the transactions of similar

nature at one place so that full information of these items may collect

under different heads. This is done in the book called ‘Ledger’. For

example, we may have accounts called ‘Salaries’, ‘Rent’, ‘Interest’,

Advertisement’, etc. To verify the arithmetical accuracy of such

accounts, the trial balance prepare.

4] Making Summaries: The classified information of the trial balance uses to prepare a profit and loss account and balance sheet

in a manner useful to the users of accounting information. As well as,

the final accounts prepare to find out the operational efficiency and

financial strength of the business.

5] Analyzing: It is the process of establishing the relationship between the items of the profit and loss account and the balance sheet.

Also, the purpose is to identify the financial strength and weaknesses

of the business. It also provides a basis for interpretation.

6] Interpreting financial information: It

is concerned with explaining the meaning and significance of the

relationships established by the analysis. It should be useful to the

users, to enable them to take correct decisions.

7] Communicating the results: The

profitability and financial position of the business as interpreted

above communicate to the interest parties at regular intervals to assist

them to make their conclusions.

Nature of Financial Accounting:-

Accounting is first step:- Accounting

is start when a financial transaction take place. It records the

financial transaction after that communicates this information to its

users. then the user this information for their decision making.

Accounting is an art and science:- Accounting

is an Art and Science as well. Accounting is an art of recording,

classifying and summarizing of financial transactions. Accounting is

science as well as it requires certain principles (accounting

principle).

Accounting is a process:- Accounting

is a process recording of financial transaction, summarizing,

analyzing, and reporting to the user of accounting information.

Accounting deals with financial transactions only:- Financial

accounting is considering only monetary transactions. It does not take

into account various non-financial aspects such as market competition,

economic conditions, government rules, and regulations, etc.

Historic In Nature:- Financial

accounting considers only those transactions which are of historic

nature. day-to-day activities transactions are recorded and the

information is provided after a period of time. All financial decisions

of the future are taken on the basis of this past information

Records Actual Cost:- Financial

accounting records the actual cost of the transaction and does not

consider the price fluctuations taking place from time to time. It

records the historical cost or the actual cost of the assets or

liability.

Advantages Financial Accounting.

Maintenance of business records: All financial transactions are recorded in a systematic manner in the books of accounts so that there is no need to rely on memory. Human memory is limited by its very nature. Accounting helps to overcome this limitation.

Preparation of financial statements: Systematic records enables the accountants to prepare the financial statements trading and profit & loss account to ascertain profit or loss during a particular accounting period and balance sheet to state the financial position of the business on a particular slate.

Comparison of results: Systematic maintenance of business records enables the accountant to compare profit of one year with those of earlier years to know the significant facts about the change.

Acts as Legal Evidence: Proper books of accounts maintained in systematic. manner act as legal evidence in case of disputes.

Facilitates Raising loans: Accounting facilitates raising loans from lenders by providing them required financial information.

Facilitates the Ascertainment of value of Business: Accounting facilitates the ascertainment of value of business’in case of transfer of business to another entity.

Assist the Management: Accounting assists the management in taking managerial decisions. For example, Projected Cash Flow Statement facilitates the management to know future receipts and payment and to take decision regarding anticipated surplus or shortage of funds.

Helps in taxation matters: Accounting facilitates the settlement of tax liability with the authorities by maintaining, proper books of accounts in systematic manner.

Facilitates control over Assets: Accounting facilitates control over assets by providing information regarding Cash Balance, Bank Balance, Stock Debtors, Fixed Assets, etc.

Limitation of Financial Accounting

Records only monetary transactions: Financial Accounting records only those transactions which can be measured in monetary terms. It has no place for recording non-monetary or non-financial transactions, though these matters also have a significant Tole in affecting the soundness of the business. For example, efficiency of the management, political situation, Government Policy, market competition etc. do affect the financial results and financial position of a business, but these are not at all recorded in accounting.

No consideration of price level changes: Accounting accepts the cost concept and hence does not consider the change in the price level from time to This is a very serious limitation of Financial Accounting.

No realistic information: Accounting information may not be realistic as accounting statements are prepared by following basic concepts. For example, Going Concern Concept gives us as idea that the business will continue and assets are to be recorded at cost but the book value, which the asset is showing, may not be actually realizable.

Personal bias of accounting affects the accounting statements: Accounting statements are influenced by the personal judgement of the account. He may select any method of depreciation, valuation of stock, and treatment of deferred revenue expenditure. Such judgement is based on integrity and competence of the accountant, and will affect the preparation of accounting statements.

Window dressing in Balance Sheet: When an accountant resorts to ‘window dressing’ in the Balance Sheet, the Balance Sheet cannot exhibit the true and fair view of the state of affairs of the business.

ACCOUNTING PRINCIPLES

Accounting principles may be defined as those rules of action or conduct which are adopted by the accountants universally while recording accounting transaction.

They are a body of doctrines commonly associated with the theory and procedure of accounting , serving as an explanation of current practices and as a guide for selection of conventions or procedures where alternative exits.

Accounting Concept

The term ‘Concepts’ includes those basic assumptions or conditions upon which the science of accounting is based.

(1) Separate Entity Concept :- According to this assumption, business is treated a s a unit separate and distinct from its owners, creditors , manager and others. In other words, the owner of a business is always considered as distinct and separate from the business he owns.

( (2) Going Concern Concept :- As per this assumption it is assumed that the business will continue to exist for a long period in the future. The transactions are recorded in the books of the business on the continuing enterprise.

(3) Money Measurement Concept :- Only those transactions and events are recorded in accounting which are capable of being expressed in terms of money. Measurement business event in the money helps in understanding the state of affairs of the business in a much better way.

(4) Cost Concept :- The resources (Land, building, machinery, property rights etc.) that a business owns are called assets. The money values assigned to assets derived from the cost concept. This concept states that an assets is worth the price paid for or cost incurred to acquire it.

(5)Dual Aspect Concept :- This is the basic concept of accounting. According to this concept every business transaction has a dual effect. If A starts a business with a capital of Rs. 10,000. There are two aspects on the transaction. The business has assets of Rs. 10,000 while on the other hand the business has to pay to the proprietor a sum of Rs. 10,000 which is taken as proprietor’s Capital.

Capital (Equities) = Cash (Assets)

10,000 = 10,000

(6) Accounting Period Concept :- According to this concept the life of the business is divided into appropriate segments for studying the results shown by the business after each segments. At the end of each segment of business or time interval is called “accounting period”.

(7) Revenue Concept :- This is based on the accounting period concept. The paramount objective of running a business is to earn. In order to ascertain the profit made by the business during a period, it is necessary that ‘revenue’ of the period. The term ‘Matching means appropriate association of relation revenue and expenses.

In other words income made by the business during a period can be measured only when the revenue earned during a period is compared with the expenditure incurred for earning that revenue.(8) Realisation Concept :- According to this concept revenue is recognised when a sale is made. Sale is considered to be made at the point when the property in goods passes to the buyer and he becomes legally liable to pay.

(B) Accounting Conventions :-

(i) Conservatism :- In the initial stages of accounting certain anticipated profits which were recorded , did not materialise. In encourages the accountant to create secrete reserves (eg., by creating excess provision for bad and doubtful debts ,depreciation etc.) and the financial statement do not depict a true and fair view of state of affair of the business.

(ii) Full disclosure :- According to this convention accounting reports should disclose fully and fairly the information they represent. They should be honestly prepared and sufficiently

disclose information which is of material interest to proprietor, present and potential creditors and investors.

(iii) Consistency :- According to this convention accounting practices should remain unchanged from one period to another. For example , if stock is valued at “Cost or market price

whichever is less, this principle should be followed year after year. Similarly if depreciation is charged on fixed assets according to diminishing balance method, It should be done year after year.

(iv) Materiality :- According to this convention the accountant should attach importance to material details and ignore insignificant details. This is because otherwise accounting will be unnecessarily overburden with minute details.

International Accounting Standards (IASs) were issued by the antecedent International Accounting Standards Council (IASC), and endorsed and amended by the International Accounting Standards Board (IASB). The IASB will also reissue standards in this series where it considers it appropriate.

International Accounting Standards (IASs) were issued by the antecedent International Accounting Standards Council (IASC), and endorsed and amended by the International Accounting Standards Board (IASB). The IASB will also reissue standards in this series where it considers it appropriate.

International Accounting Standards (IASs) were issued by the antecedent International Accounting Standards Council (IASC), and endorsed and amended by the International Accounting Standards Board (IASB). The IASB will also reissue standards in this series where it considers it appropriate.International

International Accounting Standards:-

International Accounting Standards:-

|

|

Name

|

Issued

|

|

IAS 1

|

Presentation of financial statement

|

2007*

|

|

IAS 2

|

Inventories

|

2005*

|

|

IAS 3

|

Consolidated financial statement

|

1976

|

|

IAS 4

|

Depreciation accounting

|

|

|

IAS 5

|

information to be disclosed in financial statement

|

1976

|

|

IAS 6

|

Accounting responses to changing prices

|

|

|

IAS 7

|

Statement of cash flows

|

1992

|

|

IAS 8

|

Accounting policies, Changes in estimates and errors.

|

2003

|

|

IAS 9

|

Accounting for research and development activities

|

|

|

IAS 10

|

Events after the reporting period

|

2003

|

|

IAS 11

|

Construction contracts

|

1993

|

|

IAS 12

|

Income taxes

|

1996*

|

|

IAS 13

|

Presentation of current assets and current liabilities

|

|

|

IAS 14

|

Segment reporting

|

1997

|

|

IAS 15

|

Information reflecting the effect of changing prices

|

2003

|

|

IAS 16

|

Property, plant and equipment

|

2003*

|

|

IAS 17

|

Leases

|

2003*

|

|

IAS 18

|

Revenue

|

1998

|

|

IAS 19

|

Employee Benefits

|

2011

|

|

IAS 20

|

Accounting for government grants and disclosure of government

assistance

|

1983

|

|

IAS 21

|

The effect of changes in foreign exchange rates

|

2003*

|

|

IAS 22

|

business combinations

|

1998*

|

|

IAS 23

|

Borrowing costs

|

2007*

|

|

IAS 24

|

Related party disclosures

|

2009*

|

|

IAS 25

|

Accounting for Investments

|

|

|

IAS 26

|

Accounting and reporting by retirement benefit plans

|

1987

|

|

IAS 27

|

Separate financial statement

|

2011

|

|

IAS 28

|

Investment in Associates and joint ventures

|

2003

|

|

IAS 29

|

Financial reporting in hyperinflationary economies

|

1989

|

|

IAS 30

|

Disclosures in financial statements of banks and similar

financial institution

|

1990

|

|

IAS 31

|

Interest in joint ventures

|

2003*

|

|

IAS 32

|

Financial instruments presentation

|

2003*

|

|

IAS 33

|

Earnings per share

|

2003*

|

|

IAS 34

|

Interim financial reporting

|

1998

|

|

IAS 35

|

Discontinuing operations

|

1998

|

|

IAE 36

|

Impairment of assets

|

2004*

|

|

IAS 37

|

Provisions contingent liabilities and contingent assets

|

1998

|

|

IAS 38

|

Intangible assets

|

2004*

|

|

IAS 39

|

Financial instruments recognition and Measurement

|

2003*

|

|

IAE 40

|

Investment property

|

2003*

|

|

IAS 41

|

Agriculture

|

2001

|

International Accounting Standards (IASs) were issued by the antecedent International Accounting Standards Council (IASC), and endorsed and amended by the International Accounting Standards Board (IASB). The IASB will also reissue standards in this series where it considers it appropriate.International Accounting Standards (IASs) were issued by the antecedent International Accounting Standards Council (IASC), and endorsed and amended by the International Accounting Standards Board (IASB). The IASB will also reissue standards in this series where it considers it appropria

**********************************************************************************************

UNIT

II

Royalty

Accounts

Royalty is payable by a user to the owner of the

property or something on which an owner has some special rights. A royalty

agreement is prepared between the owner and the user of such property or

rights. If payment is made to purchase the right or property that will be

treated as capital expenditure instead of a Royalty.

Payment made by the lessee on account of a royalty

is normal business expenditure and will be debited to the Royalty account. It

is a nominal account and at the end of the accounting year, balance of Royalty

account need to be transferred to the normal Trading and Profit & Loss

account. Royalty, based on the production or output, will strictly go to the

Manufacturing or Production account. In case, where the Royalty is payable on

sale basis, it will be part of the selling expenses.

Types

of Royalties:- There are following types of Royalties

Copyright −

Copyright provides a legal right to the author (of

his book/s), the photographer (on his photographs), or any such kind of

intellectual works. Copyright royalty is payable by the publisher (lessee) of a

book to the author (lessor) of that book or to the photographer, based on the

sale made by the publisher.

Mining

Royalty − Lessee of a mine or quarry pays royalty to lessor

of the mine or quarry, which is generally based on the output basis.

Patent

Royalty − Patent royalty is paid by the lessee to lessor on

the basis of output or production of the respective goods

Basis

of Royalty - In case of the patent, publisher of the book pays royalty

to the author of the book on the basis of number of books sold. So, holder of

patent gets royalty on the basis of output and the mine owner gets royalty on

the basis of production

Important

Terms:- Following are the important terms, which are used in

Royalty agreements

Royalty:- A periodic payment, which may be based on a sale or

output is called Royalty. Royalty is payable by the lessee of a mine to the

lessor, by publisher of the book to the author of the book, by the manufacturer

to the patentee, etc

Landlord:- Landlords are the persons who have the legal rights

on mine or quarry or patent right or copybook rights

Tenet:- An Author or publisher; lessee or patentor who takes

out rights (usually commercial or personal rights) from the owner on lease

against the consideration is called tenet.

Minimum

Rent:- According to the lease agreement, minimum rent,

fixed rent, or dead rent is a type of guarantee made by the lessee to the

lessor, in case of shortage of output or production or sale. It means, lessor

will receive a minimum fix rent irrespective of the reason/s of the shortage of

production.

Royalty and Related Terminologies

Lease

It is an agreement where a person acquires a right to use an asset for a

certain period of time from another person or the owner of the asset in return

for a payment. The owner is known as the Lessor. The user is the Lessee. The

amount paid is Royalties

For Example, A has developed a machine that uses less material for production.

He also got it patented. Now, B wants to use it. B will have to pay a royalty

to A for using the machine. Here, A is the lessor and B is the Lessor.

Accounting Treatment of Royalties

For the

lessee, royalties are an ordinary business expenditure. Royalty paid on the

basis of output is debited to Trading or Manufacturing A/c. Whereas, the

royalty paid on the basis of sales is debited to Profit & Loss A/c.

Minimum Rent or Fixed Rent

It is the

amount that has to be paid by the lessee to the lessor whether or not he has

derived benefit from the asset. Hence, it is also called Dead Rent or Rock

Rent. Minimum rent can be a fixed sum for every year or may change every year

as per the terms of the agreement.

- When the actual royalty for

a year is less than the minimum rent, the lessee will pay the minimum rent

to the Lessor.

- When the actual royalty for

a year is more than the minimum rent, the lessee will pay the actual

royalty to the lessor.

Short-workings

It is the

excess of Minimum Rent over the Actual Royalty payable. It is calculated only

when it is allowed to be adjusted against the future royalties by the lessor.

Short-workings = Minimum Rent – Actual Royalty

Recoupment of Short-workings

The right

of Recoupment means the right given to the lessee by the lessor to

carry-forward and set-off the short-workings from the surplus of royalties over

the Minimum Rent. It can be of two types:

- Fixed Right of Recoupment:

When the lessor allows the lessee to adjust the short-workings only for a

fixed period of time, it is known as Fixed Right of Recoupment.

- Floating Right of

Recoupment: When the lessor allows the lessee to adjust the short-working

of any year in the next two or three years, it is known as the Floating

Right of Recoupment.

Numerical :-

Hire Purchase:- Hire purchase is an

arrangement for buying expensive consumer goods, where the buyer makes an

initial down payment and pays the balance plus interest in installments. The

term hire purchase is commonly used in the United Kingdom and it's more

commonly known as an installment plan in the United States. However, there can

be a difference between the two: With some installment plans, the buyer gets

the ownership rights as soon as the contract is signed with the seller. With

hire purchase agreements, the ownership of the merchandise is not officially

transferred to the buyer until all the payments have been made.

- Hire purchase agreements are not seen as an

extension of credit.

- In a hire purchase agreement, ownership is not

transferred to the purchaser until all payments are made.

- Hire purchase agreements usually

prove to be more expensive in the long run than purchasing an item

outright.

Hire

purchase agreements are similar to rent-to-own transactions that give the

lessee the option to buy at any time during the agreement, such

as rent-to-own cars. Like rent-to-own, hire purchase can benefit consumers

with poor credit by spreading the cost of expensive items that they would

otherwise not be able to afford over an extended time period. It's not the same

as an extension of credit, though, because the purchaser technically doesn't own

the item until all of the payments are made.

Because ownership is not

transferred until the end of the agreement, hire purchase plans offer more

protection to the vendor than other sales or leasing methods for unsecured

items. That's because the items can be repossessed more easily should the buyer

be unable to keep up with the repayments.

Advantages of Hire

Purchase Agreements:- Like leasing, hire

purchase agreements allow companies with inefficient working

capital to deploy assets. It can also be more tax efficient than standard

loans because the payments are booked as expenses—though any savings will be

offset by any tax benefits from depreciation.

Businesses that require

expensive machinery—such as construction, manufacturing, plant hire, printing,

road freight, transport and engineering—may use hire purchase agreements, as

could startups that have little collateral to establish lines of credit.

A hire purchase agreement

can flatter a company's return on capital employed (ROCE)

and return on assets (ROA). This is because the company doesn't need

to use as much debt to pay for assets.

Disadvantages of Hire

Purchase Agreements:-

Hire purchase agreements

usually prove to be more expensive in the long run than making a full payment

on an asset purchase. That's because they can have much higher interest

costs. For businesses, they can also mean more administrative complexity.

In addition, hire

purchase and installment systems may tempt individuals and companies to buy

goods that are beyond their means. They may also end up paying a very high

interest rate, which does not have to be explicitly stated.

Rent-to-own arrangements

are also exempt from the Truth in Lending Act because they are seen

as rental agreements instead of an extension of credit.

Hire purchase buyers can

return the goods, rendering the original agreement void as long as they have

made the required minimum payments. However, purchasers suffer a huge loss on

returned or repossessed goods, because they lose the amount they have paid

towards the purchase up to that point.

Hire Purchase System ppt download

Inventory Valuation:- Inventory is tangible property to be consumed in production of goods or services or held for sale in the ordinary course of business. Inventories are unconsumed or unsold goods purchased or manufactured Inventories generally constitute the largest current assets of manufacturing firms.

According to Accounting Standard (AS) – 2 (Revised) Inventories are “assets: a) held for sale in the ordinary course of business; b) in the process of production for such sale; or c) in the form of materials or supplies to be consumed in the production process or in the rendering of services.”

Inventories

1. Finished goods:

- Purchased or

- Produced completely but remaining unsold

2. Work-in-progress (work-in-process):

- Units introduced into the production process but are yet to be completed.

3. Raw Materials, Components, Stores and Spares: –

- Raw materials -goods that are yet to be introduced into the production process.

- Stores and spares - factory supplies such as coolants, cleaning material, and machinery spares.

• Manufacturing concern - inventory consists of all of the above 3 components

• Trading concern -inventory consists of finished goods

Objective of Inventory Valuation:- Inventory has to be valued because of the following reasons-

(i) Determination of Income:- The valuation of inventory is necessary for determining the true income earned by the business during a particular period. Gross profit is the excess of sale over cost of goods sold. Cost of goods sold is ascertained by adding opening inventory to and deducting closing inventory from purchases.

(ii) Determination of Financial position:- Inventory at the end of a period is to be shown as a current assets in the balance sheet of the business. In the case of inventory is not properly valued, the balance sheet will not disclose the correct initial position of the business.

1. FIFO Method

This method of inventory valuation is the most appropriate method, as suggested by Accounting Standard – 2 (Revised). It is based on the approach of first in first out, i.e., the inventory which is purchased first should be used first, and the further purchased goods should be used, at last, i.e., the inventories used at last should be the most recent purchased goods. However, this method gets criticism as it leads to improper cost and revenue match as this method gives the cost of remaining inventories on the recent prices whereas the cost of goods sold is calculated on the basis of old prices.

2. LIFO Method:-

LIFO Method works on the principle of last in first out, which means the stock purchased at last will be used first for the valuation of the stock. In this method, the recent cost of goods sold is matched with the recent sales revenue, which helps in determining correct income, and there will be no unrealized profit/loss as it is the cost-based method. However, this method is not suggested by Accounting Standard – 2 (Revised).

Significance of Inventory Valuation:-

Inventory valuation plays a prominent role in evaluating the profitability of a business. Let us understand it with some more points:

- Inventory acts as a backbone for any business enterprise as the enterprise’s current assets involve more than 75% of inventories. Thus inventory valuation plays a significant role in measuring the assets of the business.

- Inventory valuation is mandatory to find out the liquidity position of an enterprise as creditors always have an eye on the liquidity position of the business.

- Inventory valuation also plays a vital role in evaluating the gross profit of any business as without proper valuation of stock; true profit cannot be ascertained.

Inventory System:-

Perpetual Inventory System:- Perpetual inventory is a method of accounting for inventory that records the sale or purchase of inventory immediately through the use of computerized point-of-sale systems and enterprise asset management software. Perpetual inventory provides a highly detailed view of changes in inventory with immediate reporting of the amount of inventory in stock, and accurately reflects the level of goods on hand. Within this system, a company makes no effort at keeping detailed inventory records of products on hand; rather, purchases of goods are recorded as a debit to the inventory database. Effectively, the cost of goods sold includes such elements as direct labor and materials costs and direct factory overhead costs.

Periodic Inventory System:-The periodic system uses an occasional physical count to measure the level of inventory and the cost of goods sold (COGS). Merchandise purchases are recorded in the purchases account. The inventory account and the cost of goods sold account are updated at the end of a set period—this could be once a month, once a quarter, or once a year. Cost of goods sold is an important accounting metric, which, when subtracted from revenue, shows a company's gross margin.

LIFO METHOD

**********************************************************************

Unit - III

Format of Trading & Profit & Loss Accounts

Departmental Accounts

Meaning of Departmental Accounts: Where a big business with diverse trading

activities is conducted under the same roof the same is usually divided into

several departments and each department deals with a particular kind of goods

or service. For example, a textile merchant may trade in cotton, woolen and

jute fabrics. The overall performance for this type of business depends,

however, on departmental efficiency.

This system of accounting actually helps the proprietors to:

(i) Compare

the results among the different departments together with the previous results

thereof,

(ii) Formulate

policy in order to extend or to develop the enterprise in the proper line; and

(iii) Reward

the departmental managers on the basis of departmental results.

👉 Advantages of Departmental Accounts: The most significant advantages of

departmental accounts are:

(a) Individual result of each department can be

known which helps to compare the performances among all the departments, i.e.,

the trading results can be compared.

(b) Departmental accounts help to understand or

locate the success, failure, rates of profit, etc.

(c) It helps the management to make proper plan

of action, policies in order to increase profit after analysing the results of

operation of various departments.

👉 Methods and Techniques of Departmental Accounts: Departmental accounts are prepared in such a

manner that all desired information are available and departmental profit can

correctly be made. However, two methods are advocated

(a) Where individual set of books are

maintained;

(b) Where all departmental accounts are

maintained columnar- wise collectively.

(a) Where Individual Set of Books are Maintained:

Under this method,

accounts of each individual department are independently maintained. The

departmental results of all the department are collected and taken into

consideration to find out the net result of the organisation.

(b)Where All Departmental Accounts are Maintained

Columnar-Wise Collectively: A Departmental Trading and Profit and Loss Account is opened

for each individual department in a columnar form together with a separate

column for ‘Total’ in order to ascertain the individual result of the different

departments and also as a whole. But the Balance Sheet is prepared in a

combined form.

Branch Accounting

Meaning of branch accounting :- Branch

accounting is a specialized accounting methods adopted by an organization which

has branches in different location. A branch is a subordinate division of an

organization. A branch is any establishment carrying on either the same or

substantially the same activity as that carried on by the head office of an

organization.

Advantages of branches:- When

an organization operates branches in different location, the following

advantages are achieved by the head office: The head office is able to extend

its operations in different locations in order to exploit the business

opportunities available in the places; Branch operations are considered to be an

effective tool to face the competition from the rival organizations;

Branch

operations facilitate effective marketing network for the overall objectives of

the organizations:

1. The expansion programmes of an organization can

be carried out through opening different branches;

2.Branch operations

facilitate more employment opportunities;

3. Branch operations

increases the turnover of the organization and thereby the profit of the

organization;

4. Branch operations

facilitate the organization to achieve economies of large scale operations.

Different types of branches:- Basically

branches can be classified into two broad categories: Inland Branches: The

branches which are located within the territory of a country in which the head

office is operating are known as inland branches Foreign Branches: The branches

which are located in any countries other than the home country in which the

head office is operating are known as foreign branches

Types of inland branches :- The inland branches can also be classified in to the following

two types: Dependent branches: The branches which do not maintain a complete

record of its transactions is said to be dependent branches. These branches

depend on the head office for the entire operations wherein all goods are

supplied by the head office and expenses are paid by the head

office. Independent branch: The branches which maintain a complete record of its

transactions is said to be independent branches. These branches are having the

freedom of own purchases and sales according to the marketing situations.

Methods of maintaining the accounts of dependent

branches:- The following are the different methods of maintaining accounts

of dependent branches: Debtors method: This method is usually adopted when the

branch is small. Under this method, the head office maintains separate branch

account for each branch. Such branch account is nominal nature. Its purpose is

to ascertain profit or loss made by each branch

Pro forma Journal entries in the books of head

office (under debtors method):-

1.

To record the opening balances of branch assets: Branch Account Dr. XXXX Brach

Assets account Cr. XXXX (Being the opening balances of assets in the branch)

2.

To record the opening balances of liabilities: Branch liabilities Account Dr.

XXXX Branch account Cr. XXXX (Being the opening balance of liabilities in the

branch)

3.When

goods are supplied to the branch: Branch Account Dr. XXXX Goods sent to branch

A/C Cr. XXXX (Being the goods sent to branch)

4. When the goods are returned by the branch:

Goods sent to branch account Dr. XXXX Branch account Cr. XXXX (Being the goods

returned by the branch)

5. When goods are supplied

by one branch to another branch under the instruction of the head office:

Branch account Cr. XXXX (Being the goods supplied to other branch)

6. When the goods supplied

by the head office but not received by the branch : Goods –in-transit account

Dr. XXXX Branch account Cr. XXXX (Being the goods in transit)

7. When the head office pays for the expenses of

the branch: Branch Account Dr. XXXX Cash/Bank account Cr. XXXX (Being the

expenses paid for the branch)

8. When the remittance is

received from the branch: Cash/Bank account Dr. XXXX Branch Account Cr. XXXX

(Being the cash received from the branch)

9. When the remittance is in-transit: Bank/Cash

in transit account Dr. XXXX Branch account Cr. XXXX (Being the cash in transit)

10. Transfer of goods sent

to branch: Goods sent to account Dr. XXXX Trading account Cr. XXXX (Being the

goods sent to branch account transferred to trading account)

To record the closing balance of branch assets:

Branch Assets Dr

11. To record the closing balance of branch assets: Branch

Assets Dr. XXXX Brach account Cr. XXXX (Being the closing balance of branch

assets)

12.

To record the closing balance of branch liabilities: Brach account Dr. XXXX

Branch liabilities account Cr. XXXX (Being the closing balance of branch

liabilities)

13.

To record profits or loss : If Profit: Brach account Dr. XXXX General Profit

and Loss A/C Cr. XXXX If Loss: General Profit and Loss A/C Dr. XXXX Branch

Account Cr. XXXX

KEY DIFFERENCES

The difference between Departmental and Branch

Accounting is as follows:

|

BASIS OF DIFFERENCE

|

DEPARTMENTAL ACCOUNTING

|

BRANCH ACCOUNTING

|

|

LINKAGE

|

Departments are attached with the main

organization under a single roof.

|

Branches are separate from the main

organization.

|

|

RESULTS OF

|

Departments are the results of fast human

life.

|

Branches are the outcomes of the tough

competition and expansion of the business.

|

|

GEOGRAPGICAL LOCATION

|

Departments are not geographically

separated.

|

Branches are geographically separated.

|

Sole Proprietorship

Sole Proprietorship, as its name suggests, is

a form of business entity in which the business is owned as well as operated by

a single person. The alternate name of this business form is sole

tradership. The person uses his capital, knowledge, skills and expertise to run

a business solely. In addition to this, he has full control over the

activities of the business. As this form of business is not a separate legal

entity, therefore the business and its owner are inseparable. All the profits

earned by the owner go to his pockets and the losses are also borne by him

only.

This form of business organisation is backed

by some advantages, like the creation of sole proprietorship is very simple,

minimal record keeping is sufficient, and it does not require, lots of

legal formalities to be complied with. Moreover, the sole proprietor also gets

the tax benefit, as the tax on his business income is regarded as the personal

income of the owner.

Partnership

The Partnership is

that form of business organisation, in which there are two or more persons

engaged together to carry on business by an agreement and decides to share

profits & losses in the specified ratio. Members are separately known as

partners, but jointly known as firm. The partnership is the unseen legal

relationship between the partners of the firm. The firm is the physical form of

the partnership, and the name under which the business is carried on is

known as Firm name.

The major components

of the partnership are an agreement between partners, sharing of profit &

loss and business to be run by all or any of the partners who will work on

behalf of the other partners. In the third component, you might notice that all

the partners are the principal as well as the agent of the other partners.

Due to this, the mutual agency is regarded as the essence of the

partnership and if this clause is not present there will be no partnership.

The following are the types of partnership:

- General Partnership

- Particular Partnership

- Partnership at will

- Limited Liability Partnership

There can be various

types of partners in a partnership firm like an active partner, sleeping

partner, nominal partner, incoming partner, outgoing partner, sub

partner, partner for profits only.

Some of the features of

partnership are:-

1. Two or More Persons: At least two

persons must pool resources to start a partnership firm. The Partnership Act,

1932 does not specify any maximum limit on the number of partners. However, the

Companies Act, 1956 lays down that any partnership or association of more than

10 persons in case of banking business and 20 persons in other types of

business6 is illegal unless registered as a joint stock company.

2. Agreement: A partnership comes into being through

an agreement between persons who are competent to enter into a contract (e.g.

Minors, lunatics, insolvents etc. not eligible). The agreement may be oral,

written or implied. It is, however, to put everything in black and white and

clear the fog surrounding all knotty issues.

3. Lawful Business: The partners can take up only legally

based activities. Any illegal activity carried out by partners does not enjoy

the legal sanction.

4. Registration: Under the Act, registration of a firm

is not compulsory. (In most states in India, registration is voluntary).

However, if the firm is not registered, certain legal benefits cannot be

obtained. The effects of non-registration are-

(i) the firm cannot take any action in

a court of law against any other parties for settlement of claims and

(ii) in case of a dispute among

partners, it is not possible to settle the disputes through a court of law.

5. Profit Sharing: The partnership agreement must specify

the manner of sharing profits and losses among partners. A charitable hospital,

educational institution run jointly by like-minded persons is not to be viewed

as partnership since there is no sharing of profits or losses. However, mere

sharing of profits is not a conclusive proof of partnership. In this sense,

employees or creditors who share profits cannot be called partners unless there

is an agreement between the partners.

6. Agency Relationship: Generally speaking, every partner is

considered to be an agent of the firm as well as other partners. Partners have

an agency relationship among themselves. The business can be carried out jointly

run by one nominated partner on behalf of all. Any acts done by a nominated

partner in good faith and on behalf of the firm are binding on other partners

as well as the firm.

7. Unlimited Liability: All partners are jointly and severally responsible for

all activities carried out by the partnership. In other words in all cases

where the assets of the firm are not sufficient to meet the obligations of

creditors of the firm, the private assets of the partners can also be attached.

The creditors can get hold one any one partner —who is financially sound-and

get their claims satisfied.

8. Not a Separate Legal Entity: The firm does not have a personality

of its own. The business gets terminated in case of death, bankruptcy or lunacy

of any one of the partners.

9. Transfer of Interest: A partner cannot transfer his interest in the firm to

outsiders unless all other partners agree unanimously. A partner is an agent of

the firm and is ineligible to transfer his interest unilaterally to outsiders.

10. Mutual Trust and

Confidence: A partnership is built around the principle of mutual trust, confidence

and understanding between partners. Each partner is supposed to act for the

benefit of all. If trust is broken and partners work at cross purposes, the

firm will get crushed under its own weight.

Key Differences Between Sole Proprietorship and Partnership

The following are the major

differences between sole proprietorship and general partnership:

- When the business is owned and

managed by a single person exclusively, it is known as the sole

proprietorship. The partnership is the business form in which the

business is carried on by two or more persons and they share profits and

losses mutually.

- Indian Partnership Act 1932 governs

the Partnership whereas there is no specific statute for Sole

Proprietorship.

- The owner of sole proprietorship business

is known as the proprietor, while the partners are the members and legal

owners of the partnership firm.

- The registration of sole

proprietorship business is not necessary, but it is at the discretion of

the partners that whether they want to register their firm or not.

- In Sole Proprietorship the minimum

and maximum limit of owners are one. Conversely, in Partnership, there

should be at least two partners, and it can exceed up to 100

partners.

- In Sole Proprietorship the

liability is borne by the proprietor only. In contrast to, Partnership

where the liability is shared between partners.

- As there is only one owner, the

quick decisions can be taken which is not in the case of a partnership

because the mutual decision is taken after discussing with all the

partners.

- There is always an uncertainty

regarding the term of the sole proprietorship as it can end up anytime if

the owner dies or if he became incompetent to run a business. On the other

hand, Partnership can be dissolved at any time, if one of the two partners

retires or dies or became insolvent, but if there are more than two

partners, it can continue at the discretion of the remaining partners.

- In sole proprietorship business,

secrecy is maintained, as the secrets are not open to any person other than

the proprietor. On the contrary, in partnership, business, business

secrets are maintained to every partner.

- The scope of raising finance is

high in partnership as compared to sole proprietorship business.

Partnership Deed:- Partnership deed is a partnership agreement between the partners of the firm which outlines the terms and conditions of the partnership between the partners. The purpose of a partnership deed is to provide clear understanding of the roles of each partner, which ensures smooth running of the operations of the firm.

The Partnership comes into the limelight when:

- There is an outcome of agreement among the partners.

- The agreement can be either in written or oral form.

- The Partnership Act does not demand that the agreement has to be in writing. Wherever it is in the form of writing, the document, which comprises terms of the agreement is called ‘Partnership Deed.’

- It usually comprises the attributes about all the characteristics influencing the association between the partners counting the aim of trade, the contribution of capital by each partner, the ratio in which the gains and losses will be divided by the partners and privilege and entitlement of partners to interest on loan, interest on capital, etc.

Partnership Deed Contents:- While making a partnership deed, all the provisions and the legal points of the partnership deed are included. This deed also includes basic guidelines for future projects and can be used as evidence at times of conflict or legal procedures. For a general partnership deed, the below mentioned information should be included.

- Name of the firm as determined by all partners.

- Name and details of all the partners of the firm.

- The date on which business commenced.

- Firm’s existence duration.

- Amount of capital contributed by each partner.

- Profit sharing ratio between the partners.

- Duties, obligations and power of each partner of the firm.

- The salary and commission if applicable that is payable to partners.

- The process of admission or retirement of a partner.

- The method used for calculating goodwill.

- The procedure that must be followed in cases of dispute arising between partners.

- Procedure for cases where a partner becomes insolvent.

- Procedure for settlement of accounts in the event of dissolution of a firm.

A Capital Account is a general ledger account which shows some of the special transactions like proprietor’s investment in his own business, the aggregate amount of earning, expenses of companies, etc. There are many more transactions which affect the Capital. Like: Interest on Capital, Interest on Drawings, Salaries to the Partners, Commission for the Partners, etc. These values are put in Profit and Loss Appropriation Account and at the same time credited or debited to their respective Capital Accounts.

Methods of Capital Account Creation

- Fluctuating Capital Account Method

- Fixed Capital Account Method

Dissolution of Partnership Firm and

Settlement of Accounts:- Dissolution of

partnership firm is a process in which relationship between partners of firm is

dissolved or terminated. If a relationship between all the partners of firm is

dissolved then it is known as dissolution of firm. In case of dissolution of

partnership of firm, the firm ceases to exist. This process includes the

discarding and disposing of all the assets of firm or and settlements of accounts,

assets, and liabilities. Learn more about Dissolution of partnership firm,

legal provisions, and settlement of accounts.

Dissolution of Partnership Firm

As we know that after the

dissolution of partnership firm the existing relationship between the partner’s

changes. But, the firm continues its activities. The dissolution of partnership

takes place in any of the following ways:

- Change in the

existing profit sharing ratio.

- Admission of a new partner

- The retirement of an existing partner

- Death of an existing partner

- Insolvency of a partner as he becomes incompetent to contract.

Thus, he can no longer be a partner in the firm.

- On completion of a specific venture in

case, the partnership was formed specifically for that particular venture.

- On expiry of the period for which the partnership

was formed.

Section 39 of the Indian Partnership Act 1932

states that the dissolution of partnership firm among all the partners of the

partnership firm is the Dissolution of the Partnership Firm. The dissolution of

partnership firm ceases the existence of the organization.

After this, the

partnership firm cannot enter into any transaction with anybody. It can only

sell the assets to realize the amount, pay the liabilities of the

firm and discharge the claims of the partners.

Following are the ways in which dissolution of a

partnership firm takes place:

1. Dissolution by

Agreement

A firm may be dissolved

if all the partners agree to the dissolution. Also, if there exists a contract between the partners regarding the

dissolution, the dissolution may take place in accordance with it.

2. Compulsory Dissolution

In the following cases the dissolution of a firm

takes place compulsorily:

- Insolvency of

all the partners or all but one partner as this makes them incompetent to

enter into a contract.

- When the business of the firm becomes illegal due to some

reason.

- When due to some event it becomes unlawful for the partnership firm

to carry its business. For example, a partnership firm has a partner who

is of another country and India declares

war against that country, then he becomes an enemy. Thus, the business

becomes unlawful.

3. When certain

contingencies happen

The dissolution of the firm takes place subject

to a contract among the partners, if:

- The firm is

formed for a fixed term, on the expiry of that term.

- The firm is

formed to carry out specific venture, on the completion of that venture.

- A partner

dies.

- A partner becomes insolvent.

4. Dissolution by Notice

When the partnership is

at will, the dissolution of a firm may take place if any one of the partners

gives a notice in writing to the other partners stating his

intention to dissolve the firm.

5. Dissolution by Court

When a partner files a

suit in the court, the court may order the dissolution of the firm on the basis

of the following grounds:

- In the case where a partner becomes insane

- In the case where a partner becomes permanently incapable of

performing his duties.

- When a

partner becomes guilty of misconduct and it affects the firm’s business

adversely.

- When a

partner continuously commits a breach of the partnership agreement.

- In a case

where a partner transfers the whole of his interest in the partnership

firm to a third party.

- In a case

where the business cannot be carried on except at a loss.

- When the

court regards the dissolution of the firm to be just and equitable on any

ground.

Unit V

FINAL ACCOUNTS OF GENERAL INSURANCE COMPANIES

All

the insurances other than the life insurance is covered under General

Insurance. It includes fire insurance, marine insurance, cargo insurance,

mobile insurance etc. The General insurance Corporation of India is the apex

general insurance institution of India. The Final Accounts of General Insurance

Companies include Revenue Account, Profit and Loss Account, and Balance Sheet.

FEATURES OF GENERAL INSURANCE

- General Insurance contract are

generally made for one year or 12 months.

- Insurance contracts can be made at

any time during the financial year.

- Premiums in respect of general

insurance are paid in the advance.

- Unexpired amount of premium is

carried forward in the next year as ‘Reserve for Unexpired Risks’.

PRINCIPLES OF GENERAL INSURANCE:- The following are the various

principles of General Insurance:

PRINCIPLES

OF UTMOST GOOD FAITH:- This

is a very basic and primary principle of insurance contracts because the

insurance company has to provide a certain level of security to the insured

person’s life. This principles states that:

- Both

parties involved in an insurance contract—the insured (policy holder) and

the insurer (the company)—should act in good faith towards each other.

- The

insurer and the insured must provide clear and concise information

regarding the terms and conditions of the contract

PRINCIPLES

OF INSURABLE INTEREST:- Insurable interest means

that the insured must have some interest in the subject matter of the insurance

contract. The subject matter of the contract must provide some financial gain

to the policyholder and would lead to a financial loss if damaged, destroyed,

stolen, or lost. This principle states that:

- The

insured must have an insurable interest in the subject matter of the

insurance contract.

- The

owner of the subject is said to have an insurable interest until he or she

is no longer the owner.

PRINCIPLE

OF INDEMNITY:- Indemnity

is a guarantee to restore the insured to the position he or she was in before

the uncertain incident that caused a loss for the insured. The

insurance company i.e. the insurer compensates the insured or policyholder

against the loss arises from the uncertain event.

The insurance company

promises to compensate the policyholder for the amount of the loss up to the

amount agreed upon in the contract.

PRINCIPLE

OF CONTRIBUTION:- Principle

of contribution is an extension of principle of indemnity. Contribution allows

for the insured to claim indemnity to the extent of actual loss from all the

insurance contracts involved in his or her claim. It allows proportional

responsibility for all insurance coverage on the same subject matter

PRINCIPLE

OF SUBROGATION:- The

principle of subrogation states that after the insured has been compensated for

the incurred loss on a piece of property that was insured, the rights of

ownership of this property go to the insurer.

This principle is applicable only when the

damaged property has any value after the event causing the damage. The insurer

can benefits out of the subrogation rights only to the extent of the amount he

has paid to the insured as compensation.

PRINCIPLE

OF PROXIMATE CAUSE:- This

principle is also known as ‘causa proxima.’

As per this principle, the loss of insured property can be caused by

more than one incident even in succession to each other. The property may be

insured against some but not all causes of loss. When a property is not insured

against all causes, the nearest cause is to be found out. If the proximate

cause is one in which the property is insured against, then the insurer must

pay compensation. If it is not a cause the property is insured against, then

the insurer doesn’t have to pay.

PRINCIPLE

OF LOSS MINIMIZATION:- This

principle states that in an uncertain event, it is the insured’s responsibility

to take all precautions to minimize the loss on the insured property. Insurance

contracts shouldn’t be about getting free stuff every time something bad

happens. Therefore, a little responsibility lies with the insured to take all

measures possible to minimize the loss on the property.

Voyage Account

Voyage Account is an

account which is prepared by the shipping companies. This account is prepared

to get a complete record of the profits earned and loss incurred on the

particular voyage undertaken by the shipping company. It records both inward

and outward journey. It is prepared separately for each voyage.

NATURE OF ACCOUNT:

Voyage Account is a nominal account. It is prepared on the basis of rule of

Nominal Account which is as follows:

“Debit all expenses & losses.

Credit all income & gains.”

PREPARATION

OF ACCOUNT: Voyage

Account is prepared by the shipping companies or marine business companies to

record the details of the particular voyage.

EXPENSES

RELATED TO VOYAGE: Voyage

account records all the expenses on the debit side. The expenses related to

voyage are as follows:

Address

commission: This

is the commission which is paid to the agents who book the freight for the

shipping companies. It is calculated as a percentage of freight and primage.

Address Commission= (Freight+ Primage)*

Rate/100

Port

Charges: The charges which

are paid to the port authorities to use the port for loading and unloading the

cargo from the ship.

Insurance: Expenses of premium paid to Insurance

Company for the insurance of ship and freight are also debited to Voyage

Account. But its premium is paid for a year. It should be adjusted according to

the period of voyage.

Depreciation: Depreciation is the decrease in the value of

the ship due to its use during the voyage. It is a non-cash expense and posted

on the debit side of the voyage account.

Stores: Stock of store is purchased during the year

for the use during the period of voyage. Stores consumed is calculated as:

(Opening stock+ Net Purchases- Closing Stock)

Stevedoring: Stevedoring are the charges of loading and

unloading of the cargo on and from the ship. It is calculated usually on the

unit basis. Example: If the stevedoring charges are Rs. 2 and units loaded are

1,000, then stevedoring is 10,000*2= Rs. 20,000.

Lighterage:

The ship usually remains at a distance from

the port in deep water. For loading and unloading the cargo, the big ships take

the help of the small ships known as Lighter. The charges paid for these

lighter is known as Lighterage.

Crew: Crew means staff working on the ship.

INCOMES

RELATED TO VOYAGE: All

the incomes related to voyage are recorded on the credit side of the voyage

account. The incomes are as follows:

Freight: Freight is the amount earned by the shipping

companies on the cargo delievered. Freight is of two types:

Freight

Inward: Earned on return

journey.

Freight

Outward: Earned on outgoing

journey.

Primage: Primage is also known as surcharge. It is

the additional freight collected as a percentage of the amount of the freight.

It is calculated as:

Primage= Freight*Rate/100

Passage

money: The ships also carry

some passengers along with the cargo on every voyage. The amount charged from

the passengers on board is known as passage money.

RESULT: The voyage account shows the profit and loss

on each voyage separately. Excess of incomes over expenses is known as profit

and excess of expenses over income is known as loss.

PREPARATION: The voyage account is prepared separately

for each voyage. It is not prepared on periodical basis rather records all the

incomes and expenses on voyage or shipment basis.

Que : Ramesh Jal Akash commenced a voyage on 1 Oct 2020 to 1 Dec 2020. Prepare voyage account

by information given below-

|

Particulars

|

Amount

|

Particulars

|

Amount

|

|

Primage

|

10%

|

Loading

Expense

|

3,000

|

|

Freight Outward

|

1,00,000

|

Unloading

|

2,000

|

|

Freight Inward

|

80,000

|

Insurance of

Ship

|

6,000

|

|

Passage Money

|

40,000

|

Insurance of

freight

|

10,000

|

|

Opening Stock

|

10,000

|

Depreciation

Annual

|

24,000

|

|

Store Purchase

|

1,00,000

|

Closing Stock

|

20,000

|

|

Capital

Expense

|

6,000

|

Address

Commission

|

12,000

|

|

Other Expenses

|

15,000

|

|

|

Solution

:-

Voyage

Account of Ramesh Jal Akash

From

India to Srilanka

(for

the period 2 Months)

|

Particulars

|

Amount

|

Particulars

|

Amount

|

|

To Opening

Stock

|

10,000

|

By Freight

(Outwards)

1,00 ,000

+ Primage10% 10,000

|

1,10,000

|

|

To Store

Purchase

|

1,00,000

|

|

To Capital

Expense

|

6,000

|

|

To Loading

expense

|

3,000

|

|

To Unloading

expense

|

2,000

|

By Freight (Inwards)

80,000

+ Primage

10% 8,000

|

88,000

|

|

To Insurance

|

6,000

|

|

To Freight

Insurance

|

10,000

|

|

To

Depreciation

|

4,000

|

|

To Address

Commission

|

12,000

|

By Passage

Money

|

40,000

|

|

To Other

Expenses

|

15,000

|

|

|

|

To

Net Profit

|

90,000

|

By Closing

Stock

|

20,000

|

|

|

|

|

|

|

Total

|

2,58,000

|

Total

|

2,58,000

|

Insurance Claim:- An insurance claim is a formal request by a policyholder to an insurance company for coverage or compensation for a covered loss or policy event. The insurance company validates the claim (or denies the claim). If it is approved, the insurance company will issue payment to the insured or an approved interested party on behalf of the insured.

Insurance claims cover everything from death benefits on life insurance policies to routine and comprehensive medical exams. In some cases, a third-party is able to file claims on behalf of the insured person. However, in the majority of cases, only the person(s) listed on the policy is entitled to claim payments.

- An insurance claim is a formal request by a policyholder to an insurance company for coverage or compensation for a covered loss or policy event.

- The insurance company validates the claim and, once approved, issues payment to the insured or an approved interested party on behalf of the insured.

- For property-casualty insurance, such as for your car or home, filing a claim can cause rate hikes to your future premiums.

Types of Insurance Claims

Health Insurance Claims:- Costs for surgical procedures or inpatient hospital stays remain prohibitively expensive. Individual or group health policies indemnify patients against financial burdens that may otherwise cause crippling financial damage. Health insurance claims filed with carriers by providers on behalf of policyholders require little effort from patients; the majority of medical are adjudicated electronically.

Property and Casualty Claims:- A house is typically one of the largest assets an individual will purchase in their lifetime. A claim filed for damage from covered perils is initially routed via the Internet to a representative of an insurer, commonly referred to as an agent or Claim Adjuster.

Life Insurance Claims:- Life insurance claims require the submission of a claim form, a death certificate, and oftentimes the original policy. The process, especially for large face value policies, may require in-depth examination by the carrier to ensure that the death of the insured did not fall under a contract exclusion, such as suicide (usually excluded for the first few years after policy inception) or death resulting from a criminal act.

Accounting for Price Level Changes:- Accounting for price-level changes also referred to as inflation accounting is a financial reporting procedure that records the consequences of inflation on the financial statements that a company prepares and publishes at the end of the financial year, which is based on the assumption of a stable currency.

There are many methods of adjustments for the effects of changes in prices. The generally accepted methods of accounting for price level changes are as under:

1. Current purchasing power method or general purchasing power method (CPP or GPP):- Under this method, any established and approved general price index is used to convert the values of various items in the Balance Sheet and Profit and Loss Account.

This method takes into consideration the changes in the value of items as a result of the general price level, but it does not account for changes in the value of individual items.

In this method, the various items of financial statements, i.e. balance sheet and profit and loss account are adjusted with the help of a recognized general price index.

The consumer price index or the wholesale price index prepared by the Reserve Bank of India can be taken for conversion of historical costs.

2. Current cost accounting method (CCA method):- The current cost accounting method is an alternative to the current purchasing power method. Price changes may be general or specific. Changes in the general level of prices which occur as a result of a change in the value of the monetary unit are measured by index numbers. Specific price changes occur if prices of a particular asset held change without any general price movements.

In the Replacement Cost Accounting technique the index used is those directly relevant to the company’s particular assets and not the general price index. In this sense, the replacement cost accounting technique is considered to be an improvement over the current purchasing power technique.

3. A hybrid method i.e mixture of CPP and CCA method.:- Three main adjustments to the trading account, calculated on the historical cost basis before interest, are required to arrive at the current cost operating profit. These are called the Depreciation Adjustment, Cost of Sales Adjustment, and Monetary Working Capital Adjustments.

The value of the net assets at the beginning and at the end of the accounting period is ascertained and the difference in the value in the beginning and the end is termed as profit or loss, as the case may be. In this method also, like replacement cost accounting technique, it is very difficult to determine relevant current values and there is an element of subjectivity in this technique.