📖 👉 E-book Link 👈 📖

Consider UNIT - I,II,III Only

👉 OLD PAPER 2016-17

Business Economics is the process of application of the principles, concepts and techniques of economics to solve the managerial problem of business and industrial enterprises.

"Business Economics is the use of economic modes of thought to analyse business situation." - Mc Nair and Meriam

"Business Economics is a study of the behaviour of firms in theory and practice." - James Bates and J.R. Parkinson

1. Opportunity Cost Principle:

This principle is of immense use in decision-making. It can be stated as; the cost involved in any decision consists of the sacrifices of alternatives required by that decision. If there are no sacrifices there are no costs.

The opportunity costs are measured by the sacrifices in terms of goods and services involved in the decision. The opportunity cost of the funds employed in one’s own business is the amount of interest income which could be earned had that been employed in other ventures.

2. Incremental Principle:

The economists make a use of the incremental principle in the theories of consumption, production pricing and distribution. In price-determination, this principle states that a firm would maximise its profits if it equates its marginal costs to its marginal revenue. In this way, this principle guides a business manager that he should expand his business in each direction only so long as the incremental benefit to his firm is more than the incremental costs.

3. Principle of Time Perspective:-

Another principle that is the principle of time perspective is useful in decision-making in output, prices, advertising and expansion of business. Economists distinguish between the short run and the long run in discussing the determination of price in a given market because in the long run a firm must cover its full cost.

On the contrary, in the short-run it can afford to ignore some of its (fixed) costs. Modern economists have started making use of an “intermediate run” between the short run and the long run in order to explain pricing and output behaviour under what is called oligopoly.

4. Discounting Principle:

Generally people consider a rupee tomorrow to be worth less than a rupee today. This is also implied by the common saying that a bird in hand is worth two in the bush. Anybody will prefer Rs. 100 today to Rs. 100 next year.

There are two main reasons for this:

(1) The future is uncertain and it is preferable to get Rs.100 today rather than a year after;

(2) Even if one is sure to receive Rs. 100 next year, one would do well to receive Rs. 100 now and invest it for a year and earn a rate of interest on Rs. 100 for one year.

5. The Equi-Marginal Principle:

This principle states that an input should be allocated in such a way that the value added by the last unit of the input is the same in all its uses. This generalized law is known as the equi-marginal principle.

Example:

Let us suppose that a firm has got two workers to employ in three activities, say production of bottled milk, butter, and cheese. The firm must allocate these workers in such a way that the marginal productivity of the last worker employed in each of these activities is the same.

Demand Forecasting

Demand forecasting is a technique that is used for estimation of what can be the demand for the upcoming product or services in the future. It is based upon the real-time analysis of demand which was there in the past for that particular product or service in the market present today. Demand forecasting must be done by a scientific approach and facts, events which are related to the forecasting must be considered.

Hence, in simple words, if someone asks what demand forecasting is, we can answer that after fetching information about different aspects of the market and demand which is dependent on the past, an attempt might be made to analyze the future demand.

This whole concept of analyzing and approximations are collectively called demand forecasting. In order to understand it more clearly, we can consider the following equation so that we can understand the concept of demand forecasting more easily.

For example, if we sold 100,150, 200 units of product Z in January, February, and March respectively, now we can approximately say that there will be a demand for 150 units of product Z in April. However, there is also a clause that the condition of the market condition should remain the same.

Demand Forecasting Objectives:-

Demand forecasting has the following objectives:

1.Demand forecasting is necessary to ascertain the future demand for

the commodity so that the firm can plan for new units, new projects,

new plants, expansion of existing scale of operation.

2.Demand forecasting will be advantageous for finding out the lines of

probable investment before taking the risk of new investment.

3.It will also be necessary to prepare plans for long term financial

requirements.

4.It helps the firm in planning for trained manpower.

**********************************************

Methods of demand forecasting:-

Concepts of Revenue

Revenue, in simple words, is the amount that a firm receives from the sale of the output. According to Prof. Dooley, ” The Revenue of a firm is its sales receipts or income.‘ In a firm, revenue is of three types:

- Total Revenue

- Average Revenue

- Marginal Revenue

Let’s look at each one of them in detail:

Total Revenue

This is simple. The Total Revenue of a firm is the amount received from the sale of the output. Therefore, the total revenue depends on the price per unit of output and the number of units sold. Hence, we have

TR = Q x P

Where,

- TR – Total Revenue

- Q – Quantity sale (units sold)

- P – Price per unit of output

Average Revenue

Average Revenue, as the name suggests, is the revenue that a firm earns per unit of output sold. Therefore, you can get the average revenue when you divide the total revenue with the total units sold. Hence, we have,

Where,

- AR – Average Revenue

- TR – Total Revenue

- Q – Total units sold

Marginal Revenue

Marginal Revenue is the amount of money that a firm receives from the sale of an additional unit. In other words, it is the additional revenue that a firm receives when an additional unit is sold. Hence, we have

MR = TRn – TRn-1

Or

Where,

- MR – Marginal Revenue

- ΔTR – Change in the Total revenue

- ΔQ – Change in the units sold

- TRn – Total Revenue of n units

- TRn-1 – Total Revenue of n-1 units

____________________________________________________________

Unit III

Production Concept

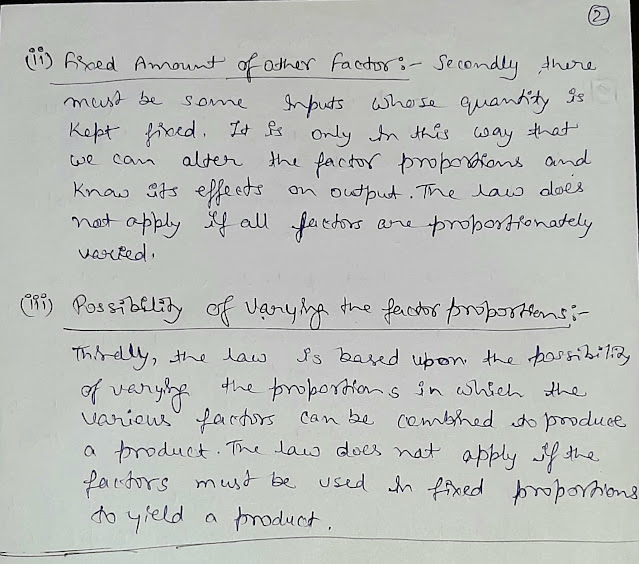

Law of Variable Proportion

Law of Returns to Scale:- In the long run all factors of production are variable. No factor is fixed. Accordingly, the scale of production can be changed by changing the quantity of all factors of production.

“The term returns to scale refers to the changes in output as all factors change by the same proportion.” - Koutsoyiannis

“Returns to scale relates to the behaviour of total output as all inputs are varied and is a long run concept”. Leibhafsky

Returns to scale are of the following three types:

1. Increasing Returns to scale.

2. Constant Returns to Scale

3. Diminishing Returns to Scale

Explanation:

In the long run, output can be increased by increasing all factors in the same proportion. Generally, laws of returns to scale refer to an increase in output due to increase in all factors in the same proportion. Such an increase is called returns to scale.

Suppose, initially production function is as follows:

P = f (L, K)

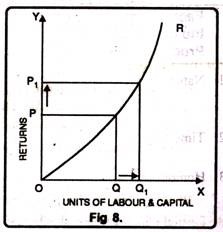

1. Increasing Returns to Scale:

Increasing returns to scale or diminishing cost refers to a situation when all factors of production are increased, output increases at a higher rate. It means if all inputs are doubled, output will also increase at the faster rate than double. Hence, it is said to be increasing returns to scale. This increase is due to many reasons like division external economies of scale. Increasing returns to scale can be illustrated with the help of a diagram

In figure 8, OX axis represents increase in labour and capital while OY axis shows increase in output. When labour and capital increases from Q to Q1, output also increases from P to P1 which is higher than the factors of production i.e. labour and capital.

2. Diminishing Returns to Scale:

Diminishing returns or increasing costs refer to that production situation, where if all the factors of production are increased in a given proportion, output increases in a smaller proportion. It means, if inputs are doubled, output will be less than doubled. If 20 percent increase in labour and capital is followed by 10 percent increase in output, then it is an instance of diminishing returns to scale.

The main cause of the operation of diminishing returns to scale is that internal and external economies are less than internal and external diseconomies. It is clear from diagram

In this diagram 9, diminishing returns to scale has been shown. On OX axis, labour and capital are given while on OY axis, output. When factors of production increase from Q to Q1 (more quantity) but as a result increase in output, i.e. P to P1 is less. We see that increase in factors of production is more and increase in production is comparatively less, thus diminishing returns to scale apply.

3. Constant Returns to Scale:

Constant returns to scale or constant cost refers to the production situation in which output increases exactly in the same proportion in which factors of production are increased. In simple terms, if factors of production are doubled output will also be doubled.

In this case internal and external economies are exactly equal to internal and external diseconomies. This situation arises when after reaching a certain level of production, economies of scale are balanced by diseconomies of scale. This is known as homogeneous production function. Cobb-Douglas linear homogenous production function is a good example of this kind. This is shown in diagram 10. In figure 10, we see that increase in factors of production i.e. labour and capital are equal to the proportion of output increase. Therefore, the result is constant returns to scale.

Economies of Scale:- Economies of scale exist when long run average costs decline as output is increased. Diseconomies of scale exist when long run average cost rises as output is increased. There are various factors influencing the economies of scale of an organisation. They are generally classified into two categories as Internal Economies & External Economies.

Internal Economies:-

1. Labour Economies:- If the labour force of a firm is specialised in a specific skill then the organisation can achieve conomies of scale due to higher labour productivity.

2. Technical Economies:- With the use of advanced technology they can produce large quantities with quality which reduces their cost of production.

3. Managerial Economies:- The Managerial skills of an organisation will be advantageous to achieve economies of scale in various business activities.

4. Marketing Economies:- Use of various marketing strategies will help in achieving economies of scale.

5. Financial Economies:- The firm's financial soundness and past record of financial transactions will help them to get financial facilities easily.

6. Economies of risk spreading:- Having variety of products and diversification will help them to spread their risk and reduce losses.

7. Economies of scale in purchase:- When the organisation purchases raw material in bulk reduces the transportation cost and maintains uniform quality.

External Economies:-

1. Research and Development:- Research facilities will provide opportunities to introduce new products and process methods.

2. Training & Development:- Continuous training and development of skills in the managerial, Production level will achieve economies of scale.

3. Economies of location:- The plant location plays a major role in cutting down the cost material, transport and other expenses.

4. Economies of Information Technology:- Advanced information technology provides timely accurate information for better decision making and for better services.

*Concept of Cost:- Cost analysis involves the study of total costs incurred by an organization to acquire various resources, such as labor, raw materials, machines, land, and technology. It helps an organization to make various managerial decisions, including determination of price and level of current production.

The concept of cost of production is very significant in economics because it influences the production, supply, sales and the determination of price in the market.

It means cost of production is a function of total costs in relation to price to guide the firm in deciding whether to expand or contract output and also whether to leave or enter an industry.

Marshall made a distinction between the cost of production and the expenses (expenditures) of production by saying that, “All the efforts and sacrifices made by the producer is the real cost of production while the money paid to other factors of production for these efforts is termed as the expenses of production”.

According to Prof. Watson, cost function can be expressed as:

C= f (q)

Where:

C = Cost of Production

q = output

f= functional relationship

However, Prof. Koutsoyiannis states “cost functions are derived functions. They are derived from the production function.”

For easy and clear understanding, cost of production can be

1. Money Costs:

Money cost is also known as the nominal cost. It is nothing but the expenses incurred by a firm to produce a commodity. For instance, the cost of producing 200 chairs is Rs. 10000, and then it will be called the money cost of producing 200 chairs.

Therefore, money costs include the following expenses:

(i) Depreciation and obsolescence charges.

(ii) Power fuel charges.

(iii) Wages and salaries.

(iv) Cost of machinery, raw material etc.

(v) Expenses on advertising and publicity,

(vi) Interest on capital.

(vii) Expenses on electricity.

(viii) Insurance charges.

Therefore, money costs relate to money outlays by a firm on factors of

production which enable the firm to produce and sell a product. Every

producer is interested only in nominal costs. Thus, in the words of

Prof. Hanson, “The money cost of producing a certain output of a

commodity is the sum of all the payments to the factors of production

engaged in the production of that commodity.”

Moreover, total costs of a firm include both:

(i) Explicit as well as

(ii) Implicit costs.

(a) Explicit Costs:

Explicit costs refer to all those expenses made by a firm to buy goods directly. They include, payments for raw material, taxes and depreciation charges, transportation, power, high fuel, advertising and so on.

(b) Implicit Costs:

Implicit costs are the imputed value of the entrepreneur’s own resources and Services. In fact, these costs refer to the implied or unnoticed costs. They include the interest on his own capital, rent on his land, wages of his own labour etc. Moreover, these costs go to the entrepreneur himself and are not recorded in practice. In the words of Leftwitch, “Implicit costs are the costs of self-owned, self employed resources.”

In short we can say that:

Economic costs = Explicit costs – Implicit costs

2. Real Costs:- According to Marshall, “Real costs are the exertion of all the different kinds of labour that are directly or indirectly involved in making it together with the abstinence rather than the waiting required for saving the capital used in making it, all these efforts and sacrifices together will be called the real cost of production of the commodity.”

3. Opportunity Costs:

The concept of opportunity costs was first systematically developed by Austrian School of Economics. Later on, it was popularized by American economist named Davenport. It is also known as the alternative cost or transfer cost. In simple words, opportunity cost is the cost of production of any unit of commodity for the value of factors of production used in producing other unit.

* Nature of Short -Run Cost Curve:-

********************************************************************************************************************

UNIT - IV

Good pricing strategies help in determining the price point at which one can maximize profits on the sale of its goods or services. While setting prices, one needs to consider various factors like demand and supply of goods or services in the market, selling and distribution cost, offerings of competitors in the market, target customers, etc.

1. Cost-plus Pricing:- It is the simplest pricing method. The firm calculates the cost of producing the good and adds on a percentage (profit) to that price to give the selling price.

2.

Limit Pricing:-

A limit

price is a price set by a monopolist to discourage economic entry into a

market. The limit price is often lower than the average cost of production.

3. Penetration Pricing:- Setting the price lower than what it is offered by other competitors in order to attract customers and gain market share. The price can be raised later once this market share is gained.

4.

Price Discrimination:-

Price

discrimination

is setting a different price for the same product in different segments to the

market. For

example,

this can be for different classes of buyers, such as ages, or for different

opening times.

" Economists understand by the term market, not any particular place at which things are bought and sold but the whole of region in which buyers and sellers are in such a interchange with one another that price of same goods tend to equalise easily and quickly. - Cournot

Let us then list a few features of a market,

- In economics, the term market will refer to the market for one commodity or a set of commodities. For example a market for coffee, a market for rice, a market for TV’s, etc.

- A market is also not restricted to one physical or geographical location. It covers a general wide area and the demand and supply forces of the region.

- There must be a group of buyers and sellers of the commodity to constitute a market. And the relations between these sellers and buyers must be business relations.

- Both the sellers and buyers must have access to knowledge about the market. There should be an awareness of the demand for products, consumer choices, and preferences, fashion trends, etc.

- At any given time only one price can be prevalent in the market for the goods and services. This is only possible in the existence of perfect competition.

Classification of Markets

Now we have seen what is a market. Let us learn more about the classification of markets. Broadly there are two classifications of markets – the product market and the factor market. The factor market refers to the market for the buying and selling of factors of production like land, capital, labor, etc. The other classification of markets are as follows,

On the Basis of Geographic Location

- Local Markets: In such a market the buyers and sellers are limited to the local region or area. They usually sell perishable goods of daily use since the transport of such goods can be expensive.

- Regional Markets: These markets cover a wider are than local markets like a district, or a cluster of few smaller states

- National Market: This is when the demand for the goods is limited to one specific country. Or the government may not allow the trade of such goods outside national boundaries.

- International Market: When the demand for the product is international and the goods are also traded internationally in bulk quantities, we call it an international market.

On the Basis of Time

- Very Short Period Market: This is when the supply of the goods is fixed, and so it cannot be changed instantaneously. Say for example the market for flowers, vegetables. Fruits etc. The price of goods will depend on demand.

- Short Period Market: The market is slightly longer than the previous one. Here the supply can be slightly adjusted.

- Long Period Market: Here the supply can be changed easily by scaling production. So it can change according to the demand of the market. So the market will determine its equilibrium price in time.

On the Basis of Nature of Transaction

- Spot Market: This is where spot transactions occur, that is the money is paid immediately. There is no system of credit

- Future Market: This is where the transactions are credit transactions. There is a promise to pay the consideration sometime in the future.

On the Basis of Regulation

- Regulated Market: In such a market there is some oversight by appropriate government authorities. This is to ensure there are no unfair trade practices in the market. Such markets may refer to a product or even a group of products. For example, the stock market is a highly regulated market.

- Unregulated Market: This is an absolutely free market. There is no oversight or regulation, the market forces decide everything

Monopsony:-

A monopsony is a market condition in which there is only one buyer, the monopsonist. Like a monopoly, a monopsony also has imperfect market conditions. The difference between a monopoly and monopsony is primarily in the difference between the controlling entities. A single buyer dominates a monopsonized market while an individual seller controls a monopolized market. Monosonists are common to areas where they supply most or all of the region's jobs.

- A monopsony refers to a market dominated by a single buyer.

- In a monopsony, a single buyer generally has a controlling advantage that drives its consumption price levels down.

- Monopsonies commonly experience low prices from wholesalers and an advantage in paid wages.

Bilateral Monopoly:-

A bilateral monopoly exists when a market has only one supplier and one buyer. The one supplier will tend to act as a monopoly power and look to charge high prices to the one buyer. The lone buyer will look towards paying a price that is as low as possible. Since both parties have conflicting goals, the two sides must negotiate based on the relative bargaining power of each, with a final price settling in between the two sides' points of maximum profit.

This climate can exist whenever there is a small contained market, which limits the number of players, or when there are multiple players but the costs to switch buyers or sellers is prohibitively expensive.

- First of all, for there to be a bilateral monopoly, there can only be a single supplier and a single applicant.

- Second, in any bilateral monopoly the negotiating parties will determine how this market works.

- Prices resulting from a bilateral monopoly are generally lower than those from a monopoly.

- Prices resulting from a bilateral monopoly are generally higher than those from a monopsony.

NOTE:- Please add content related to "Supply Analysis". Note down supply analysis after demand concept.

Price determination under Perfect Competition:-

Content Updated.👇

************************************************************

Profit:- Profit can be stated as remuneration to the entrepreneur for his services rendered in the production process.

1. Profit as a Residual Income:- Economists are of the opinions that profit is a residual income which accrues to the entrepreneur after all types of payments have been made and all types of production expenses have been met.

2. Profit as a rewards for Entrepreneurial Services:- Prof. Henry Grayson pointed out that profit may be considered : (a) A reward for making innovations. (b) A reward for accepting risks and uncertainties. (c) A result of imperfections in the market structure.

Features of Profits:- Profit has the following features:

(i) Residual Income:- Profit is a residual income that an entrepreneur gets when he deducts from his total revenue of the business total cost (Explicit & Implicit).

Profit = Total Revenue - Explicit & Implicit cost

(ii) More fluctuation in Profits:- During the period of depression and boom , there exists more fluctuations in profits as compared to the income of other factors of production.

(iii) Profits may be negative:- Profit may be zero or negative. On the contrary Land, labour and capital always earn positive price for their services.

(A) Gross Profit :- In Economics , gross profit is distinguished from net profit. The surplus which remains after payment to all factors hired contractually and such current obligations like taxes and depreciation charges is the gross profit.

Gross Profit= Total revenue - Explicit cost

(B) Net Profit:- Gross profit contains some implicit cost elements of factor services owned and provided by entrepreneur himself. We must deduct these implicit profits from gross profit to arrive at net profit. Net profit contains the followings:-

(i) Reward for risk:- According to Prof. Henry Clay, " That it is owners of business who take the chief risk is clear when we remember that they have paid for the labour, capital and land before the commodity is finished often before its price can be found and if the commodity when made is not wanted and cannot be sold, they cannot recover wages, interest and rent, expanded in the production of it."

(ii) Net profit is the result of the bargaining skill of the entrepreneur:- If the entrepreneur is able to obtain the services of factors of production at lower rates the cost of production will be less, which automatically helps him to increase the rate of profit.

we can express the net profit thus;

Net Profit = Gross Profit - Implicit cost

= Total Revenue - Explicit Cost - Implicit Cost

= Total revenue - Total Cost

* Normal Profit:- Normal profits are minimum profits necessary to induce an entrepreneur to remain in industry in the long period. Normal profits may be called the translate earnings of an entrepreneur, which he must earn in his current enterprise to continue i the long period or else he would leave the industry.

Normal profits influence the price of the product hence they are included in the cost of production.

* Abnormal Profits:- Abnormal profit is also known as supernormal profit or excess profit. Such excess profit may be earned only when the market is an imperfect one. Abnormal profits arise due to monopoly position, windfall gains. Therefore, it does not a pert of the cost of production and enter into price.

Theories

of Profit: Profits

of businesses depend on the successful management of risks and uncertainties by

entrepreneurs. These risks can be cost risks due to change in wage rates,

prices, or technology, and other market risks. Different economists have

presented different views on profit. Some of the most popular theories of

profit are shown in Figure-1:

The different theories of profit

(as shown in Figure-1).

(1) Walker’s Theory: An

American economist, Prof F. A. Walker propounded the theory of profit, known as

rent theory of profit. According to him “as rent is the difference between

least and most fertile land similarly, profit is the difference between

earnings of the least and most efficient entrepreneurs.” He advocated that

profit is the rent of exceptional abilities that an entrepreneur possesses over

others.

According to Walker; profit is the difference between the earnings of the least and most efficient entrepreneurs. An entrepreneur with the least efficiency generally strives to cover only the cost of production. On the other hand, an efficient entrepreneur is rewarded with profit for his differential ability.

Thus, profit is also said to be

the reward for differential ability of the entrepreneur. While formulating this

theory, Walker assumed the condition of perfect competition in which all

organizations are supposed to have equal managerial ability. In this case,

there is no pure profit and all the organizations earn only managerial wages

known as normal profit. The rent theory was mainly criticized for its inability

to explain the real nature of profits.

Apart from this, the theory

failed on the following aspects:

a. Provides only a measure of

profit. The theory does not focus on the nature of profit, which is of utmost

importance.

b. Assumes that profits arise

because of the superior or exceptional ability of the entrepreneur, which is

not always true. Profit can also be the result of the monopolistic position of

the entrepreneur.

(2) Clark’s Dynamic Theory:

Clark’s dynamic theory was

introduced by an American economist, J.B. Clark. According to him, profit does

not arise in a static economy, but arise in a dynamic economy. A static economy

is characterized as the one where the size of population, the amount of

capital, nature of human wants, the methods of production remain the same and

there is no risk and uncertainty. Therefore, according to Clark, only normal

profits are earned in the static economy. However, an economy is always dynamic

in nature that changes from time to time.

A dynamic economy is

characterized by increase in population, increase in capital, multiplication of

consumer wants, advancement in production techniques, and changes in the form

of business organizations. The dynamic world offers opportunities to

entrepreneurs to make pure profits.

According to Clark, the role of

entrepreneurs in a dynamic environment is to take advantage of changes that

help in promoting businesses, expanding sales, and reducing costs. The

entrepreneurs, who successfully take advantage of changing conditions in a

dynamic economy, make pure profit.

There are internal and external

factors that make the world dynamic. The internal changes are changes that take

place within the organization, such as layoff and hiring of employees, product

changes, and changes in infrastructure. The external changes are of two kinds,

namely, regular changes and irregular changes.

Regular

changes involve fluctuations in trades that affect profits On the other hand;

irregular changes include contingencies, such fire, earthquake, floods, and

war. Thus, according to Clark, profits are a result of changes and no profit is

generated in case of static economy.

However Prof Knight criticized

the dynamic theory on the basis that only those changes that cannot be foreseen

yield profits. He further says, “It cannot, then, be change, which is the cause

of profit, since if the law of change is known, as in fact is largely the case,

no profits can arise. Change may cause a situation out of which profit will be

made, if it brings about ignorance of the future.”

(3) Hawley’s Risk Theory:

The risk theory of profit was

given by F. B. Hawley in 1893. According to Hawley, “profit is the reward of

risk taking in a business. During the conduct of any business activity, all

other factors of production i.e. land, labor, capital have guaranteed incomes

from the entrepreneur. They are least concerned whether the entrepreneur makes

the profit or undergoes losses.”

Hawley refers profit as a reward

for taking risk. According to him, the greater the risk, the higher is the

expected profit. The risks arise in the business due to various reasons, such

as non-availability of crucial raw materials, introduction of better

substitutes by competitors, obsolescence of a technology, fall in the market

prices, and natural and manmade disasters. Risks in businesses are inevitable

and cannot be predicted. According to Hawley, an entrepreneur is rewarded for

undertaking risks.

There is a criticism against this

theory that profits arise not because risks are borne, but because the superior

entrepreneurs are able to reduce them. The profits arise only because of better

management and supervision by entrepreneurs. Another criticism is that profits

are never in the proportion to the risk undertaken. Profits may be more in enterprises

with low risks and less in enterprises with high risks.

(4) Knight’s Theory: Prof Knight propounded the theory

known as uncertainty-bearing theory of profits. According to the theory, profit

is a reward for the uncertainty bearing and not the risk taking. Knight divided

the risks into calculable and non-calculable risks. Calculable risks are those

risks whose probability of occurrence can be easily estimated with the help of

the given data, such as risks due to fire and theft.

The calculable risks can be

insured. On the other hand, non-calculable risks are those risks that cannot be

accurately calculated and insured such as shifts in demand of a product. These

non-calculable risks are uncertain, while calculable risks are certain and can

be anticipated.

According to Knight, “risks are

foreseen in nature and can be insured”. Thus, risk taking is not a function of

an entrepreneur, but of insurance organizations. Therefore, an entrepreneur

gets profit as a reward for bearing uncertainties and not for risks that are

borne by insurance organizations.

The theory of uncertainty bearing

is criticized on the following grounds:

a)

Assumes

that profit is the result of uncertainty bearing ability of an entrepreneur,

which does not always hold true. The profit can also be the reward for other

aspects, such as strong co-ordination and market share.

b)

Fails

to show any relevance with the real world.

(5) Schumpeter’s Innovation Theory: Joseph Schumpeter propounded a theory called innovation according to which profits are the reward for innovation He advocated that innovation is the introduction of a new product, new technology, new method of production, and new sources of raw materials. This helps in lowering the cost of production or improving the quality of production. Innovation also includes new policy or measure by an entrepreneur for an organization.

In general, innovation can take place in two ways, which are as follows:

a. Reducing the cost of

production and earning high profit. The cost of production can be reduced by

introducing new machines and improving production techniques.

b. Stimulating the demand by

enhancing the existing improvement or finding new markets.

According to innovation theory,

profit is the cause and effect of innovations. In other words, it acts as a

necessary incentive for making innovation.

Schumpeter’s innovation theory is criticized on two aspects, which are as follows:

a. Ignores uncertainty as a

source of profit

b. Denies the role of risk in

profit

Functions

of Profit: Profit

is the primary objective of all business organizations. The expectation of

earning higher profits of business organizations induces them to invest money

in new ventures. This results in large employment opportunities in the economy

which further raises the level of income. Consequently, there is a rise in the

demand for goods and services in the economy. In this way, profit generated by

business organizations play a significant role in the economy.

According to Peter Ducker, there

are three main purposes of profit, which are explained as follows:

i. Tool for measuring performance: It refers to the fact that profit generated by an organization helps in estimating the effectiveness of its business efforts. If the profits earned by an organization are high, it indicates the efficient management of its business. However, profit is not the most efficient measure of estimating the business efficiency of an organization, but is useful to measure the general efficiency of the organization.

ii. Source of covering costs: Helps organizations to cover

various costs, such as replacement costs, technical costs, and costs related to

other risks and uncertainties. An organization needs to earn sufficient profit

to cover its various costs and survive in the business.

iii. Aid to ensure future

capital: Assures the availability of

capital in future for various purposes, such as innovation and expansion. For

example, if the retained profits of an organization are high, it may invest in

various projects. This would help in the business expansion and success of the

organization.

Apart from above mentioned functions, following are the positive results of high profits:

i. Investment in research and development: It leads to better technology and dynamic efficiency. An organization invests in research and development activities for its further expansion, if it earns high profit. The organization would lose its competitiveness, if it does not invest in research and development activities.

ii. Reward for shareholders: It includes dividends for shareholders. If an organization earns high profits, it would provide high dividends to shareholders. As a result, the organization would attract more investors, which are crucial for the growth of the organization.

iii. Aid for economies: It implies that profits are helpful for economies. If organizations generate high profits, they would be able to cope with adverse economic situations, such as recession and inflation. This results in stability of economies even in adverse situations.

iv. Tool to stimulate government finances: It implies that if the profits generated by organizations are high, they are liable for paying high taxes. This helps government to earn high revenue and spend for social welfare.

Breakeven Point (BEP)?

Break-even analysis is an economic tool that is used to determine the cost structure of a company or the number of units that need to be sold to cover the cost. Break-even is a circumstance where a company neither makes a profit nor loss but recovers all the money spent.

The break-even analysis is used to examine the relation between the fixed cost, variable cost, and revenue. Usually, an organisation with a low fixed cost will have a low break-even point of sale.

Importance of Break-Even Analysis

- Manages the size of units to be sold: With the help of break-even analysis, the company or the owner comes to know how many units need to be sold to cover the cost. The variable cost and the selling price of an individual product and the total cost are required to evaluate the break-even analysis.

- Budgeting and setting targets: Since the company or the owner knows at which point a company can break-even, it is easy for them to fix a goal and set a budget for the firm accordingly. This analysis can also be practised in establishing a realistic target for a company.

- Manage the margin of safety: In a financial breakdown, the sales of a company tend to decrease. The break-even analysis helps the company to decide the least number of sales required to make profits. With the margin of safety reports, the management can execute a high business decision.

- Monitors and controls cost: Companies’ profit margin can be affected by the fixed and variable cost. Therefore, with break-even analysis, the management can detect if any effects are changing the cost.

- Helps to design pricing strategy: The break-even point can be affected if there is any change in the pricing of a product. For example, if the selling price is raised, then the quantity of the product to be sold to break-even will be reduced. Similarly, if the selling price is reduced, then a company needs to sell extra to break-even.

Components of Break-Even Analysis

- Fixed costs: These costs are also known as overhead costs. These costs materialise once the financial activity of a business starts. The fixed prices include taxes, salaries, rents, depreciation cost, labour cost, interests, energy cost, etc.

- Variable costs: These costs fluctuate and will decrease or increase according to the volume of the production. These costs include packaging cost, cost of raw material, fuel, and other materials related to production.

Uses of Break-Even Analysis

- New business: For a new venture, a break-even analysis is essential. It guides the management with pricing strategy and is practical about the cost. This analysis also gives an idea if the new business is productive.

- Manufacture new products: If an existing company is going to launch a new product, then they still have to focus on a break-even analysis before starting and see if the product adds necessary expenditure to the company.

- Change in business model: The break-even analysis works even if there is a change in any business model like shifting from retail business to wholesale business. This analysis will help the company to determine if the selling price of a product needs to change.

Break-Even Analysis Formula

Break-even point = Fixed cost/-Price per cost – Variable cost

Example of break-even analysis

Company X sells a pen. The company first determined the fixed costs, which include a lease, property tax, and salaries. They sum up to ₹1,00,000. The variable cost linked with manufacturing one pen is ₹2 per unit. So, the pen is sold at a premium price of ₹10.

Therefore, to determine the break-even point of Company X, the premium pen will be:

Break-even point = Fixed cost/Price per cost – Variable cost

= ₹1,00,000/(₹12 – ₹2)

= 1,oo,000/10

= 10,000

Therefore, given the variable costs, fixed costs, and selling price of the pen, company X would need to sell 10,000 units of pens to break-even.

The above-mentioned is the concept of ‘Break-Even Analysis

*********************************************************************************************

Ppt of Micro-Economics & Macro Economics

What is Microeconomics:

The

study of choices made by individuals and businesses about the resource's

allocation and prices of goods and services is known as Microeconomics.

Microeconomics is concerned with the supply of goods and services, which

defines the economy's price level.

In

order to analyze the economy, the microeconomy uses the bottom-up approach. In

other terms, microeconomics aims to comprehend human decision-making and

resource distribution. It does not determine what changes are occurring in the

market; rather, it discusses why those changes occur. Microeconomics' main goal

is to figure out how a business can maximize its output to reduce costs and

succeed in its market. We can obtain huge information regarding microeconomics

from the financial statements. Examples of Microeconomy; price of the product and Individual demand.

Microeconomics

Contains:

- Individual consumer behavior

such as Consumer choice theory.

- Production and

consumption-related externalities such as Externalities.

- Supply and demand in a

particular market.

- Individual labor markets such

as wage determination and demand for labor.

Importance of Microeconomics:-

Microeconomics has a wide range of theoretical and

practical applications. As a result of this, even the Neo-classical economists

focused on microeconomics. Although Keynes' popularity grew, the relevance of

microeconomics has not diminished.

1. Efficient Allocation of Resources

Microeconomics assumes that consumers and producers

function rationally. The producer investigates the various options and

calculates the excepted advantages and costs of each option.

The best use of resources comes from rational actions.

Microeconomics instructs you on how to make the most efficient use of your

resources. Microeconomics deals with the allocation of resources in the

production of goods and services. It specifies which product should be

produced, how much should be produced, and why it should be produced.

2. Understand the Working of the Economy: Microeconomics knowledge is needed to understand how the economy works. The economy comprises the public as well as the private sector. The study of individual industry, wages, individual taxes, salary calculation, and foreign trade, is based on microeconomic principles. Correspondingly, various government operations can be evaluated using private-sector concepts. Such as the cost of national defense, price determination by the post office, etc., are analyzed with the help of the micro-economics.

3. Study of Human Behavior

Microeconomics is a branch of economics that explores a

wide range of human behavior. The law of diminishing utility, indifference

curve theory, equip-marginal utility, each study human behavior. Economy theory

may be used to explain a process in the economy. Positive economics is a term

used to describe this type of descriptive theory.

For example; When apples are in short supply,

the price increases. According to the positive theory, one thing leads to

another. The cause is a shortage of apples, and the result is a price increase.

Economic theory may also be applied to determining what

should occur. A normative theory is described as one that prescribes policy

action.

4. Examine Conditions of Economic Welfare

The normative price theory is known as welfare economics. Welfare economics is the study

of people's well-being as producers and consumers. It makes recommendations to

improve people's welfare.

It aids in the reduction of waste and

enhancement of social welfare. It describes and analyses economic efficiency

principles.

5. Formulation of Public Policies

Microeconomics aids the government in formulating various

economic policies that benefit the general public. It provides tools and

foundations for the study of economic policy.

The economy is influenced by economic policy. It results

in a change in resource distribution, such as the public policy regarding

loans, tax, price, subsidy, etc.

A benefit-cost analysis is a useful technique that is

often used in public policy decisions. Microeconomics supports the government

in making the most efficient use of limited resources.

What is Macroeconomics:-

Macroeconomics is an economics branch that shows a large

picture. It examines the economy on a large scale, and many economic problems

are taken into account.

Macroeconomics measures and interprets the problems that

an economy faces and the progress that it makes. Microeconomics is the study of

the relationship between countries and how one country's policies affect the

other. It delimits its scope by analyzing the effectiveness and failure of

government policies.

In macroeconomics, we usually survey the relationship

between the nation's total manufacturing and the degree of employment, and

other factors such as cost prices, rates of interest, profits, wage rates,

etc., focusing on a single fictitious good and what occurs to it. Example of

Macroeconomics; General price level, Poverty, Rate of unemployment, Aggregated

demand as well as supply and National income and savings

Macroeconomics contains:

- Economic growth

- Government borrowing

- Internet trade and

globalization

- Reasons for inflation and

unemployment

- Causes of disparities in living

standards and economic growth among nations.

- Monetary/fiscal policy. E.g.,

what effect do interest rates have on the entire economy?

Importance of

Macroeconomics:-

With the help of the following points,

we can define the importance of Macroeconomics:

1. Economic Fluctuations

With the help of macroeconomics, we can analyze the

reasons of fluctuations in employment, income, output and try to control them

or decrease their severity.

2. Performance of an Economy

With the help of macroeconomics, we can examine the

economy's performance. National Income (NI) estimates are used to measure the

economy's performance over time by comparing the production of goods and

services from one era to the next.

3. National Income

The analysis of national income and social accounts has

become increasingly important as a result of macroeconomic research. It is

impossible to formulate the right economic policies without conducting a

national income analysis.

4. Functioning of an Economy

Macroeconomics theory helps you understand how an

economic structure works. It assists us in comprehending the behavior pattern

of aggregative variables in a vast and complex economic system.

5. Level of Employment

Macroeconomics is a branch of economics that studies an

economy's overall employment and production.

***************************************************************************************

Basic concepts on Economics

1. Who is the father of Economics ?

- Adam Smith

2. Economic survey is published by :

- Ministry of Finance

3. The concept of Five Year Plans in India was Introduced by

- Jawaharlal Nehru

4. The first Chairman of the Planning Commission was

- Pt. Jawaharlal Nehru

5. National Development Council was set up in:

- 1952

6. In Economics, production means

- Creating Utility

7. Malthusian theory of population explored the relationship between

- Food supply and population growth

Sir pepar 7 s h sir or dar lag rha h acank s date a gai h

ReplyDelete